Spot Bottlenecks. Speed Up Loans.

Discover what's slowing you down-and how to fix it for good.

Loan delays aren't just annoying-they're expensive. Most teams focus on visible stages, missing the real slowdowns hidden between them. Check out the below infographic to learn how Skan AI gives you full visibility into underwriting workflows, so your team can eliminate waste, speed decisions, and boost ROI.

What if you could see exactly where delays happen and fix those specific problems?

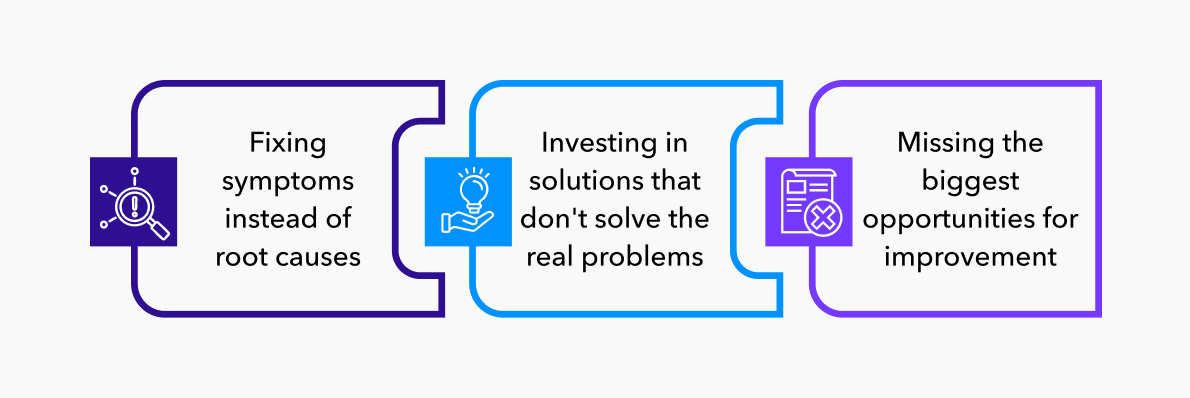

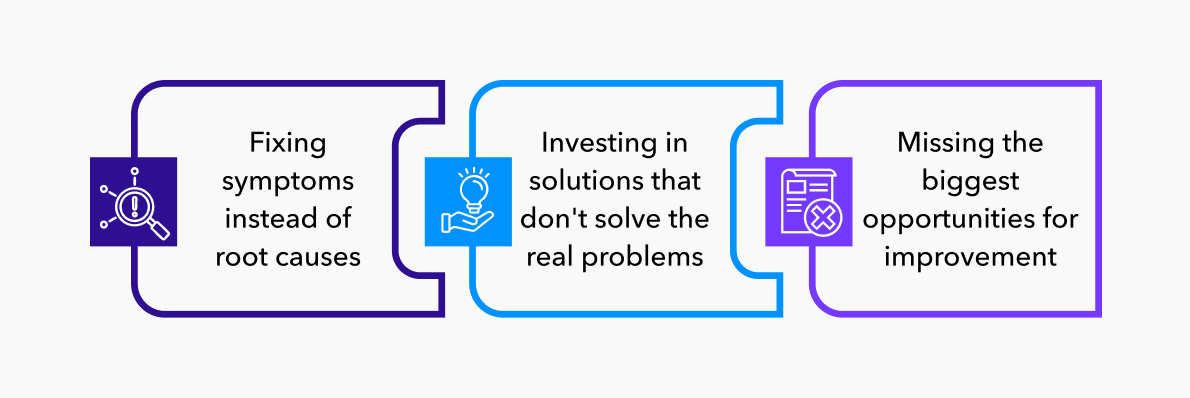

The Visibility Problem

Most lenders only see parts of their process. They track how long applications sit in each stage but miss tasks from in-between stages. This leads to:

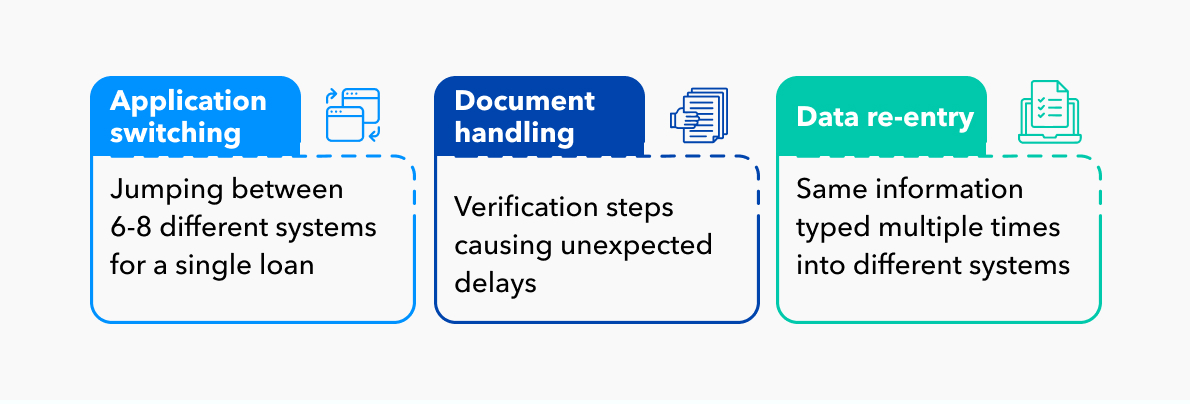

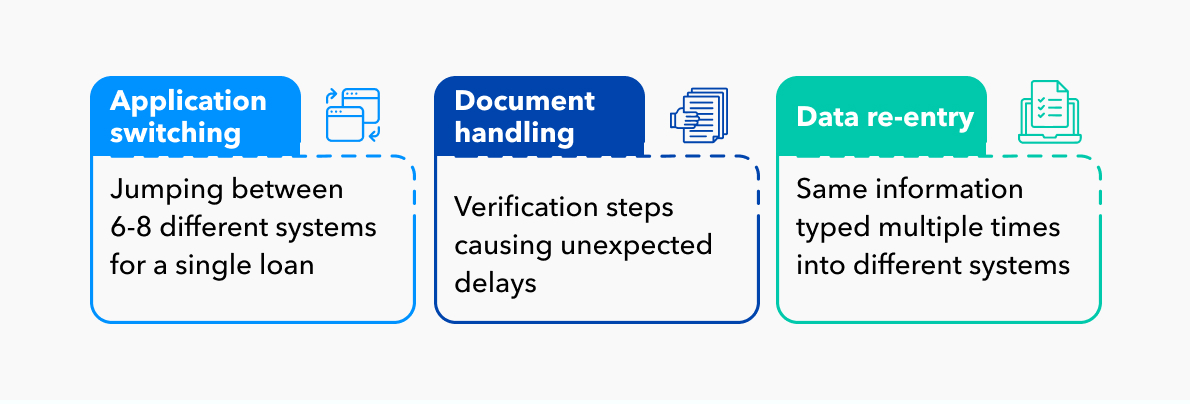

What are the Most Common Challenges Slowing Down Underwriting Operations

Many issues can cause delays, but our experience shows the most common challenges arise from these three issues:

- application switching

- document handling

- data re-entry

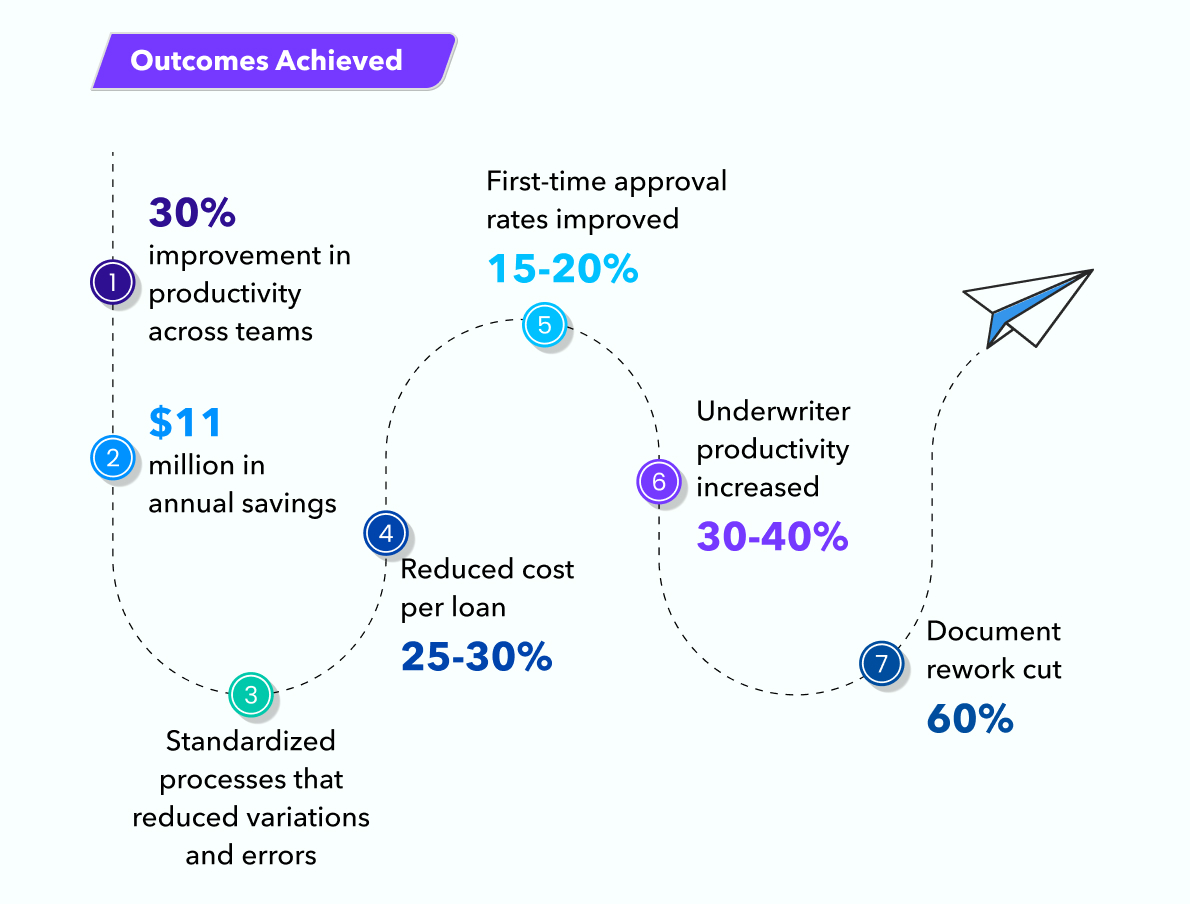

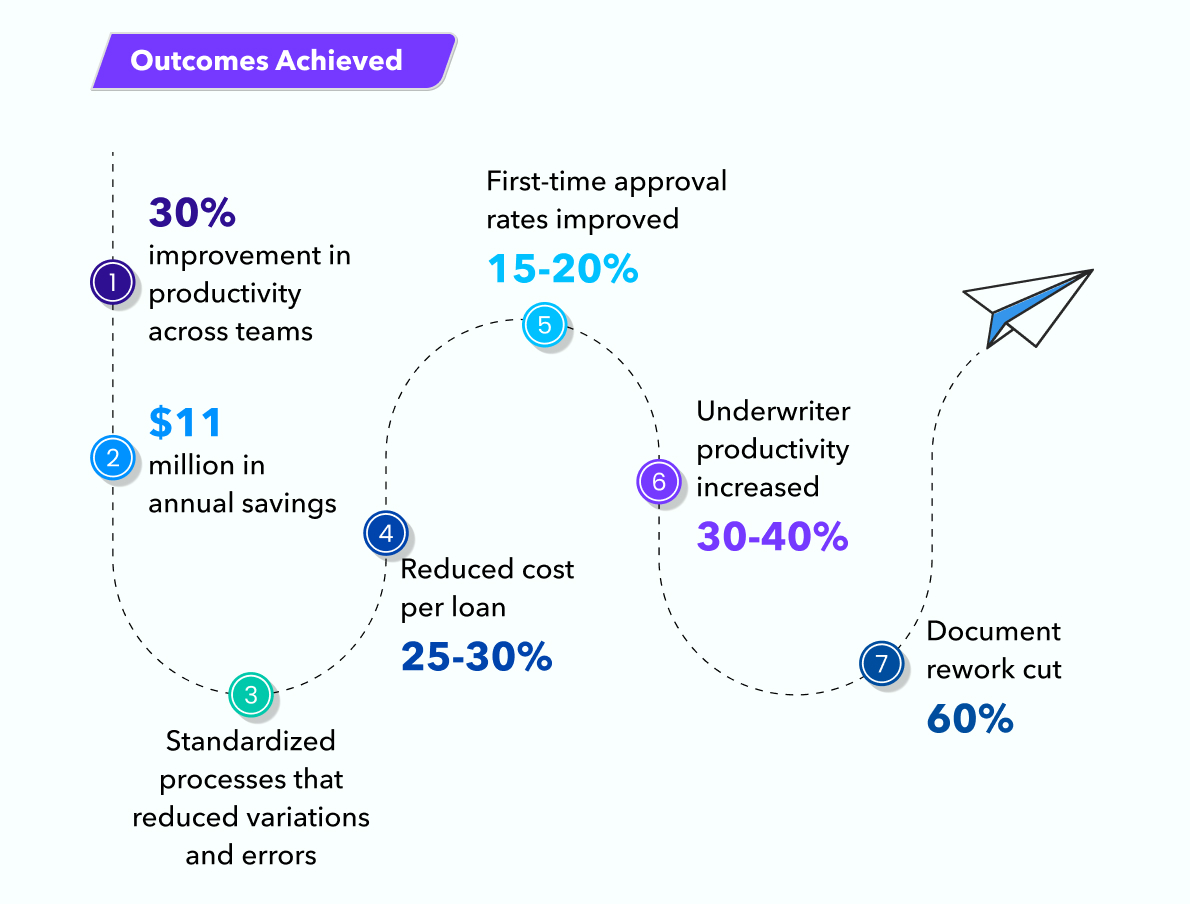

Real Results: 30% Productivity Boost

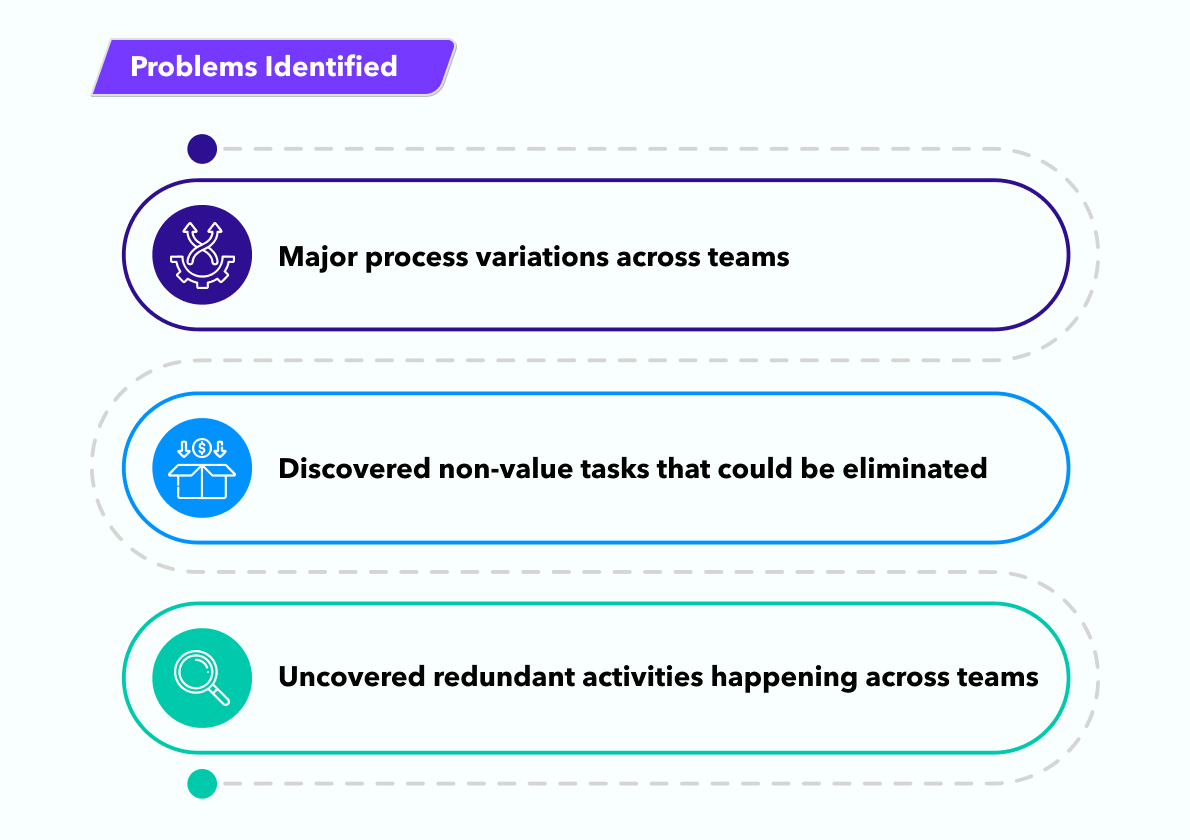

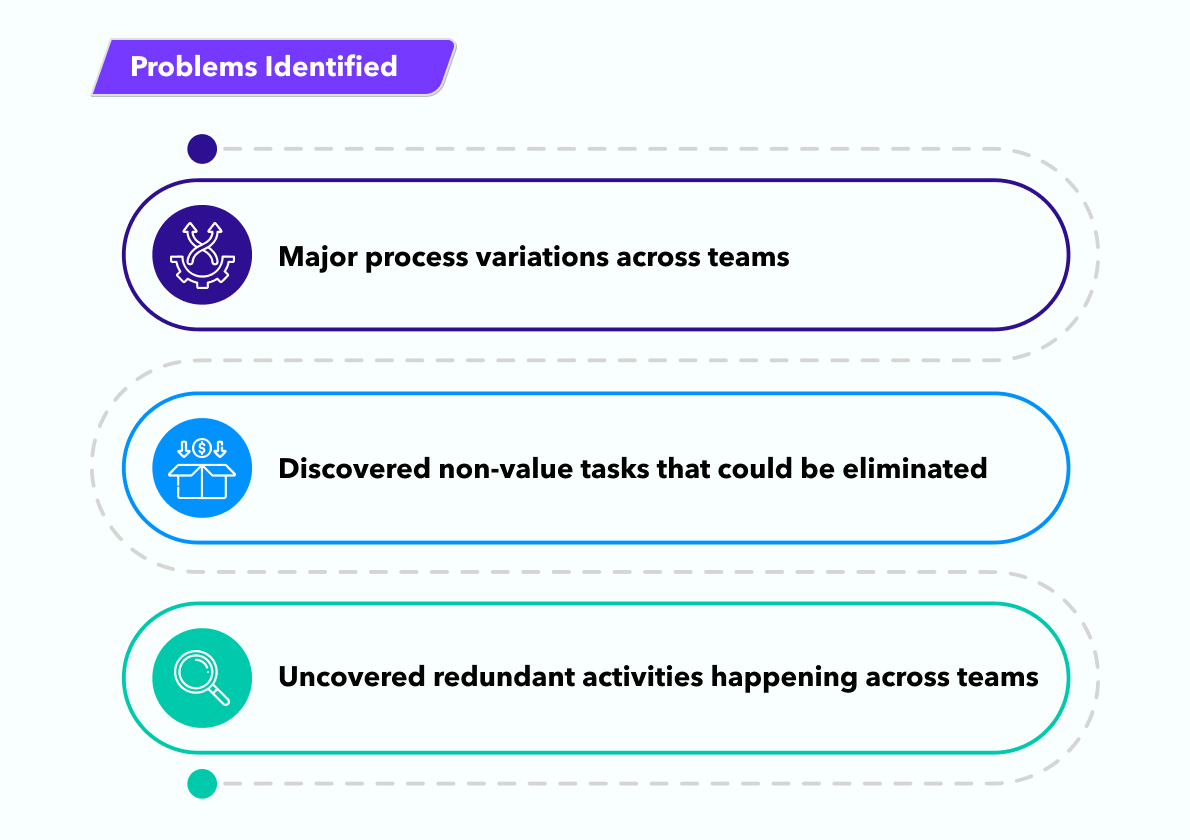

A leading underwriter recently deployed Skan AI across their entire operation, observing end-to-end actions across 3 underwriting teams-capturing every step, every application, and every outcome.

Improve Processes, Improve Revenue

With true process understanding, enterprises can unlock better productivity, more revenue, reduced costs, and so much more.

You can't fix what you can't see. Want to see where your underwriting bottlenecks are hiding?