Quick Summary: Banks are using automation (RPA & AI) to cut costs, make faster decisions, and create better customer experiences. This guide helps IT leaders spot the best automation chances using process intelligence and shows real results from top banks.

What is Banking Automation?

Banking automation uses software to handle tasks that people used to do manually. This cuts costs, speeds up work, and reduces mistakes.

Two main types of banking automation:

|

RPA (Robotic Process Automation)

|

AI-Powered Automation

|

|

Follows set rules

|

Learns and adapts

|

|

Handles repetitive tasks

|

Makes predictions

|

|

Needs human guidance

|

Works more independently

|

|

Example: Data entry

|

Example: Fraud detection

|

What Are the Key Banking Automation Technologies

RPA (Robotic Process Automation)

RPA uses software bots to handle repetitive tasks. In banking, these bots can:

- Enter data across multiple systems

- Process invoices and payments

- Handle basic customer service requests

- Update account information

RPA works best for tasks with clear rules that don't change often.

AI and Predictive Banking

Unlike RPA, AI doesn't just follow rules—it learns from data. AI systems in banking:

- Analyze huge amounts of data in real-time

- Spot patterns humans might miss

- Make predictions about future trends

- Adapt to new information without human help

The mix of AI with banking is called "predictive banking"—using past data to guess what will happen next. This helps banks make smarter, faster decisions. This also creates the foundation for Agentic AI use cases.

What Are the Top Use Cases for Banking Automation

1. Fraud Detection

Problem: Banks lose billions yearly to fraud that's getting more complex.

Solution: AI systems analyze transaction patterns to spot suspicious activity in real-time.

Real Results:

- BNP Paribas uses machine learning to find unusual patterns in transactions

- Danske Bank improved fraud detection accuracy from 40% to 95% in just five months

- Modern AI systems can spot fraud types never seen before

2. Faster Loan Approvals

Problem: Traditional loan approval takes weeks and misses good customers without perfect credit histories.

Solution: AI assesses creditworthiness using thousands of data points beyond credit scores.

Real Results:

- Lenddo examines 12,000 characteristics from social media and online behavior

- Banks using AI can safely approve more applications in less time

- Crest Financial offers loans up to $250k with no financial statements

3. Smart Budgeting Tools

Problem: Customers struggle to manage finances without personalized guidance.

Solution: AI-powered apps analyze spending patterns and offer tailored advice.

Real Results:

- Better use of mobile apps to flag unusual bills and suggest reviews

- Automated travel notifications reduce fraud alerts while traveling

- Personalized insights increase customer satisfaction and loyalty

4. Streamlined Compliance

Problem: KYC and AML checks are time-consuming and prone to errors.

Solution: AI automates document processing and risk assessment.

Real Results:

Process Intelligence: Finding Hidden Automation Opportunities

Process intelligence is the missing link in many automation projects. Before you can automate, you need to know exactly how your processes work in reality—not just how they're supposed to work.

How Does Process Intelligence Work

- Process Discovery: Special software watches how work actually happens across systems

- Process Analysis: AI finds patterns, bottlenecks, and automation opportunities

- Evaluate: See the ROI of different automation options before spending money

- Monitoring: Track results and find more ways to improve

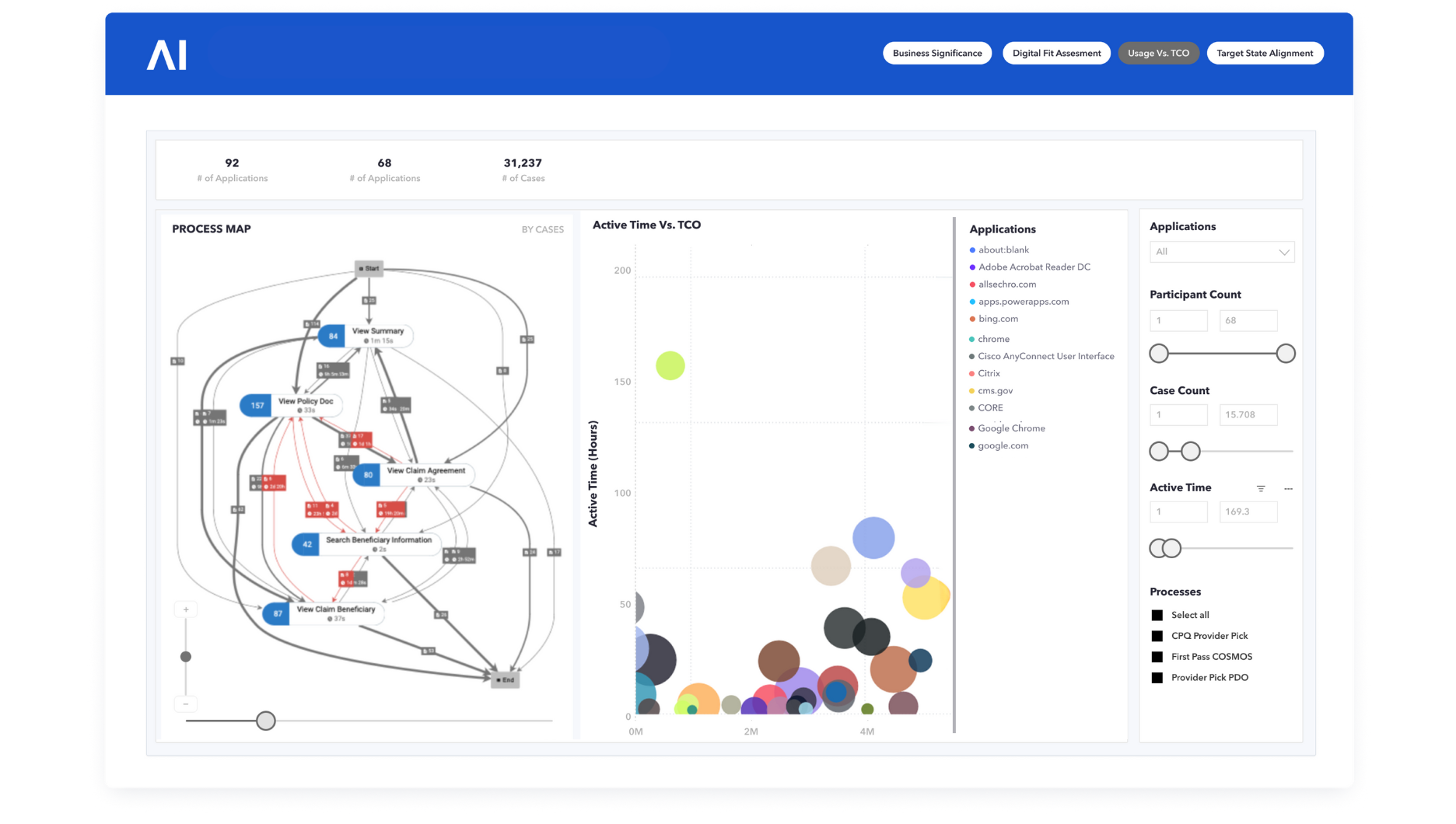

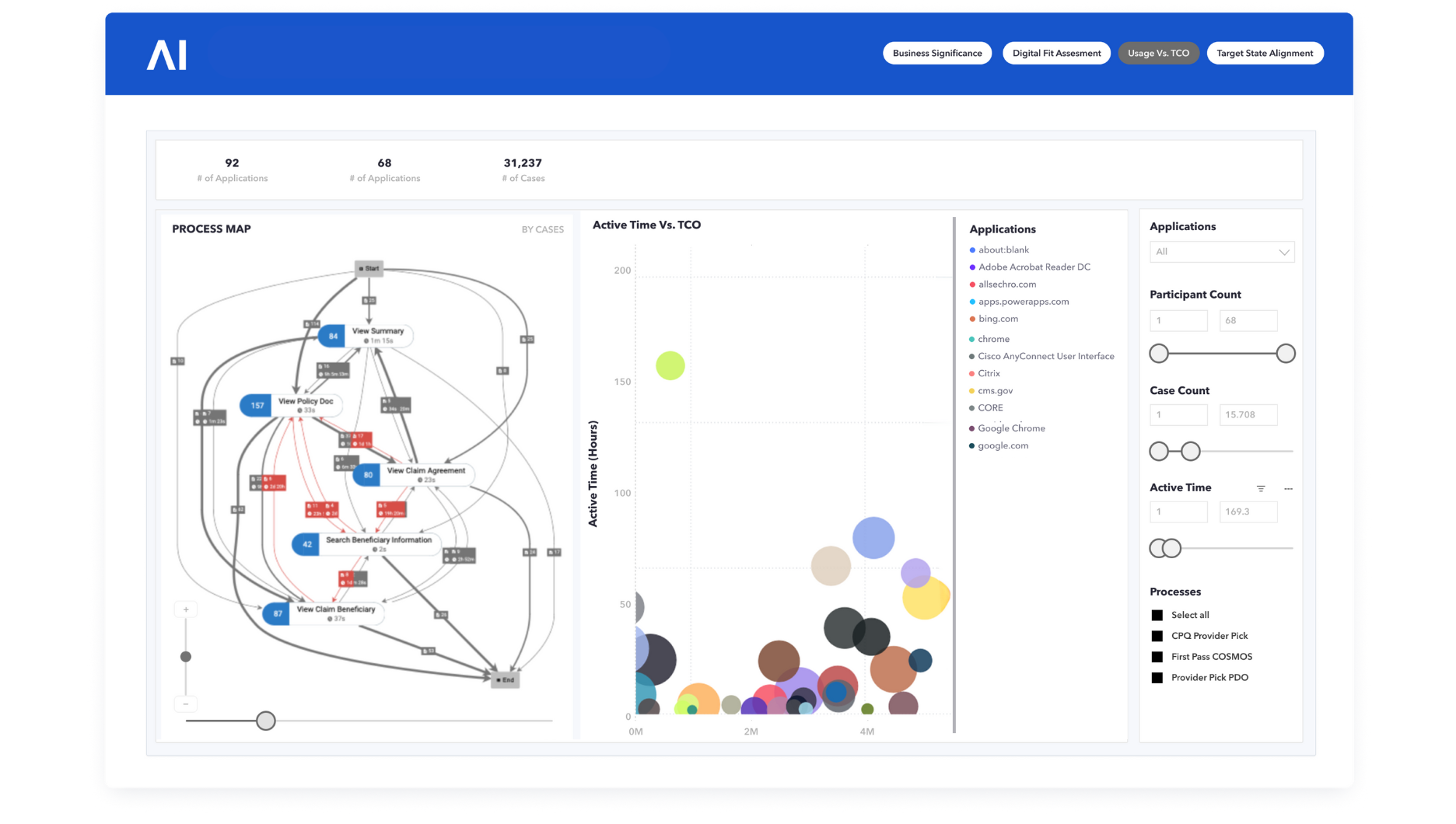

Skan AI: Next-Generation Process Intelligence

Skan AI's process intelligence platform goes beyond traditional process mining by:

Capturing every user action without needing system logs. Skan AI observes human work from the desktop, so every step in a process is available for analysis, not just one system.

Works across all applications. Skan AI can observe every application, including legacy mainframes and VDI desktops, which are common in banks.

Protecting privacy while still showing the complete process. Sensitive information is both redacted and stored locally. This is all part of Skan AI’s privacy-first architecture.

Scaling to any size organization. Skan AI can observe processes that cover large teams (thousands), teams that are geographically spread out, and long-duration cases that span days to weeks.

Banking Process Intelligence Use Cases

- Customer Onboarding: Find why some applications take 3x longer than others

- Loan Processing: Spot which steps cause the most delays

- Compliance Checks: See which checks could be safely automated

- Back-Office Operations: Identify which 20% of tasks cause 80% of the work

Implementation & ROI Expectations

How to Get Started With Banking Automation

- Start with Skan AI to find the best banking automation opportunities, but also to eliminate redundant or non-value-added tasks

- Pick quick wins first: Choose high-volume, rule-based processes

- Build a center of excellence with both business and IT experts

- Create a roadmap from simple automation to advanced AI capabilities

Common Implementation Challenges to Consider

Process variations: Different teams follow different workflows even though they are working on the same cases. The need to scale observation analytics across teams is important to find the optimal and suboptimal workflows.

Change management: Staff resistance to new ways of working. Using productivity analysis to help educate staff on why change is better for their

Governance: Balancing speed with control and compliance. Protecting sensitive data is a must in banking use cases.

Next Steps

Ready to find automation opportunities in your bank?

Request our free Process Intelligence Assessment to discover where automation will have the biggest impact.

Contact Us Today →

Frequently Asked Questions

Q: Which processes should we automate first? A: Start with high-volume, rule-based tasks that don't change often. Use process intelligence to find these opportunities.

Q: How can we measure automation success? A: Track time saved, error reduction, cost savings, and customer satisfaction. Set clear KPIs before starting.

Q: Do we need to replace our core banking systems? A: No. Modern RPA and AI solutions can work with your existing systems.

Q: How can we ensure compliance with banking regulations? A: Choose automation tools with built-in compliance features and audit trails.

Q: What skills do we need on our team? A: The best practice is to build a center of excellence (COE) with a mix of process experts, developers, data scientists, and change management specialists.

.png?width=736&height=491&name=Automation%20Opportunities%20In%20Banking-%20Blog%20Who%20are%20we%20(1).png)